Wanted: 2.5 million more senior living workers. Please apply before 2030.

The senior living industry directly employs more than 767,000 Americans, and indirectly employs more than 915,000 workers in related industries. This industry, with nearly a quarter-trillion dollars in economic impact, drives economies from local to global. These thousands of workers are licensed and registered nurses, managers, sales and marketing officers, hospitality and maintenance workers, accountants, information technology workers, cooks…and direct caregivers.

This industry’s job growth is projected to zoom up by more than 30 percent—that’s nearly five times stronger than the total U.S. economy—through 2025. With the recent health of the U.S. economy, many providers already report shortages of high-quality caregivers, dining workers, and more.

But they’re trying to turn this around. Approaches vary by provider and mission, but some of the strategies include:

• Making the hire-to-onboarding gap shorter, and keeping the process dynamic—without compromising the care needed to find high-quality candidates

• Using technology to make it easier for candidates to apply and to help them to stay

• Offering education, certifications, apprenticeships, and other ways to keep improving quality while helping workers move up and earn more

Over the next several pages, you’ll read about these and more—plus there’s a list of tips and ideas from people on the job, to inspire changes of your own.

The Fast-Growing Technologies That Automate Hiring

“Robots” surround us: Automated communication and decision-assisting tools help us with everything from scheduling a dentist appointment to deciding what to watch on TV.

The senior living workforce environment is no exception. An automated service can send texts to a candidate as a reminder of an interview time and what to bring. Or predict whether a candidate is likely to stay with the job.

There’s a big variety in such solutions, with more being developed and added all the time. But representatives with the companies that create them say deciding what to use starts with knowing your business culture, strategy, and resources.

As anyone in hiring and staff development knows, gathering and interpreting data about people is complex and ever-changing—because people themselves are. While an applicant tracking system (ATS) can do a lot on its own, automated solutions that work with it can make a difference.

Shorter hiring time

The first benefit to using automated systems is to streamline hiring time. “Good people are off the market in three to five days now,” says Mark Woodka, CEO at OnShift, a human capital management software company with many solutions specifically for the senior living employment market. Its automated text responses system can cut time to hire in half and lead to 60 percent fewer no-shows, the company says.

That’s a use David Wilkins also applauds. He is chief strategy officer at HealthcareSource, which provides talent management software and services and also has senior living as an area of specialization. “I think the best use of this tech is via process automation—like AI-based chat-bots that can interact with a candidate or applicant and, in the process, take over for some of the simple stuff that recruiters do, to free them up for more critical tasks,” he writes in an email interview.

Seeing what’s ahead

Then there is the exciting—and potentially more problematic—idea that automated services can predict a job applicant’s behavior. Will that bright, skilled, and enthusiastic interviewee decide in six months that she always really wanted to be a trapeze artist, and leave you in the lurch? More and more companies say they can help you see that coming, but they use different methods to get there.

HealthcareSource, for instance, bases its predictions on massive amounts of data from the past and today. It uses behavioral assessment tools to “evaluate compassion, stress tolerance, communication, accountability, and customer focus, among other traits,” Wilkins writes.

Their system then compares responses to similar responses from workers with a strong track record. “We’ve looked at hundreds of thousands of hires and their subsequent job performance, which enabled us to create a predictive index, so that when someone scores a certain way, we have very high confidence in their job fit, their service orientation, and even their turnover risk,” Wilkins writes.

One client reduced first-year turnover by 43 percent. Another found that the “ideal hires” identified through the system were 64 percent more likely to make it past the 90-day mark.

Using machine learning

Another method uses machine learning to make predictions about employees. It’s a complicated topic, but a simple explanation serves: A computer is fed large amounts of foundational data, and continuously fed more data. It uses its own artificial intelligence to “learn” what the data means. It looks for patterns and elements that stand out from patterns, matches them up to previous and current patterns in hiring or retention, and draws its own conclusions. The more data, the more it learns.

The hiring suggestions that result from machine learning can be counterintuitive or even puzzling. For instance, for a client that operated both a hospital and a long-term care service, Arena found that a CNA who was also a leader in a neighborhood organization was slightly more likely to be retained in the hospital—and slightly more likely to leave, when working in long-term care.

Or when a candidate was asked about working for a faith-based organization, the answer itself didn’t matter as much as the number of words an applicant used in writing the answer: more words, better job fit.

The results can be uncannily accurate. In one of its first forays, even before the company became Arena, Rosenbaum had made a goal to reduce turnover at a hospital by 10 percent. At first, turnover decreased by 58 percent. As the machine-learned more, turnover decreased by 77 percent.

Arena also predicts who might do best in specific positions. Beyond the basic skills, hiring managers will typically look for someone who is compassionate, who cares. “But the reality is that someone who really thrives in memory care may not thrive in assisted living,” Rosenbaum says. Job applicants don’t always know where they’ll be happiest, nor may those hiring, so the predictions “give each side a clearer sense of what’s likely to happen.”

Potential drawbacks

The consideration raised about predictive methods is the concern about bias. In the early days of machine learning, for instance, systems reflected their designers—the typically younger, white males of the tech innovation world. Their implicit biases and backgrounds could then throw off the prediction and perpetuate more bias, creating a cycle.

Rosenbaum, of Arena, got into the senior living hiring field to break that cycle; he wanted to create a hiring system that could vastly reduce bias. In 2010, he tested it out on a hospital system after he heard the turnover rate in that industry could reach 40 percent. As he learned more about health care hiring, he started exploring the senior living area. “Today, we’re almost entirely in hospitals, skilled nursing, and CCRCs,” he says, not least because they like the people.

Bias isn’t confined to machine learning: Even an automated response system for a mobile phone could potentially be problematic, if a person blocks calls or if the permission to text isn’t given. A company takes the chance of overlooking someone without a mobile or who is less tech-savvy but would still make a good hire.

Have the conversation

State and federal regulators have been eyeing predictive hiring techniques as well, with Illinois this year passing limits on algorithms interpreting facial expressions in video interviews, and U.S. House Democrats introducing the Algorithmic Accountability Act of 2019 (H.R. 2231), which calls for “automated decision system impact assessments.”

“I think for the most part it’s good that states and the federal government have this conversation,” Rosenbaum says.

“We want as a society to have a conversation about what we should and shouldn’t use. When people don’t understand how machine learning works, it can have a lot of unintended consequences.”

Change is a constant

Whatever automated methods you use, they’ll need to be updated over time, as the industry and community needs change.

For example, HealthcareSource in June added additional competencies to its staff assessment after extensive research, including measurements for “emotional evenness.”

The new competencies “provide additional insights into applicants and correlate strongly to job performance ratings and customer service behaviors,” a company statement says.

“If there’s a new executive director, almost always our algorithms need to change,” says Rosenbaum of Arena’s systems.

Balancing the costs

Woodka has found two more hurdles that can make providers reluctant to use more automation.

One is senior living’s reputation for the personal touch. But automated responses early in the process can be personalized enough that a candidate will feel acknowledged, and that time saved can be applied to in-person interviewing.

The second is common to any product or service: price. While OnShift sells such services, Woodka gave advice that works across the board: Get solid data on turnover and on who is being lost during the application process, then work out the costs of these, so you can make an informed comparison and decide what you need.

Emerging Solutions for Growth and Retention: Apprenticeship Programs

The momentum for apprenticeship is building. Although such programs have often been used in manufacturing or skilled labor, the current administration and Department of Labor have prioritized new models of apprenticeship in fields where it hasn’t often been used before, such as health care and hospitality.

Senior living looks like the perfect fit: Providers want to ensure recruitment and retention of quality workers, and the new generation of employees tend to want meaningful and valuable benefits.

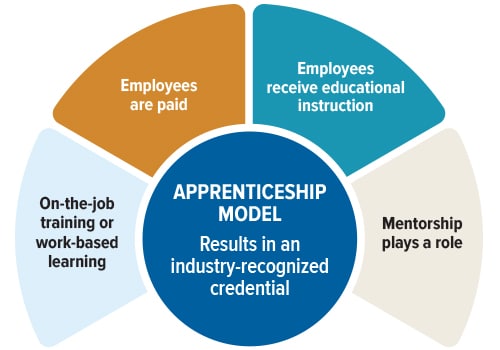

Apprenticeship combines several features that make the model especially effective at retaining and developing workers. At its core, apprenticeship defines career ladders for employees, with on-the-job training as well as instruction that can be done in classrooms, online, or with an in-person trainer. When employees complete a rung of the ladder, they earn a raise or a promotion. In addition, apprentices are paid. There is also a mentorship component to provide guidance.

In April 2019, Argentum announced an industry-led initiative to strengthen career pathways in senior living, building from apprenticeship programs developed by several Argentum members. Trilogy Health Services, for instance, launched its registered apprenticeship in 2017, and now has one of the largest apprenticeships in Indiana, Kentucky, Michigan, and Ohio, the four states where it has operations. The company has registered more than 4,000 apprentices and has recorded more than 4,000 nurse aide certifications and more than 1,000 culinary certifications. Early results show a marked rise in retention of Trilogy employees who complete at least one level of their apprenticeship.

Just starting a program is Dallas-based Capital Senior Living, one of the dozen health care companies participating in a $12 million federal apprenticeship grant through the Dallas County Community College District (DCCCD). Capital Senior Living has 128 communities over 23 states, offering independent living, assisted living, and memory care.

While the work is just beginning, the goal is for Capital Senior Living to offer 400 apprenticeships, helping workers earn certified nursing assistant (CNA), licensed practical or vocational nurse (LPN/LVN), and registered nurse (RN) certifications. The grant overall will support training for 7,500 apprentices in about 50 health care occupations.

Argentum talked with Jeremy Falke, Capital Senior Living’s vice president of human resources, about plans, processes, and experiences in getting started that he could share with other providers.

Relationships are key

Apprenticeship programs often require collaboration and partnerships to cover the variety of capabilities needed. Falke, who joined Capital Senior Living in February 2018, had 20 years’ experience in acute care hospitals, and Capital Senior Living was invited into the partnership because of his previous relationships and work in the area.

“We were pretty active in engaging in state, federal, local workforce grant programs, through local workforce organizations to fund education…to the tune of $2 to $4 million a year, across the country.

“I knew this space a little bit, and I know how powerful it is, and how helpful it can be—and how untapped at times it is.”

Identify a career ladder

Senior living has a natural career ladder, Falke says, where someone can come in with no clinical experience and move up from CNA to LPN, then to RN, then to wellness director, even to executive director.

Although the Capital Senior Living plan concentrates on health care, other areas in senior living such as dining, sales, and management have clearly structured career ladders, and some providers are designing programs in these areas.

Moving people up the ladder as they become certified and experienced can be done more quickly and easily in a senior living setting than in a hospital. Senior living is known as a setting where high-quality, motivated employees can rise fairly quickly.

Recruitment and retention

Apprenticeship can help in recruitment and retention, but it’s not just another benefit. “This piece is a little different, in that it gives you education.”

“It’s powerful when you’re giving someone something that can never be taken away from them,” Falke says. “Something that is transferable and portable, that is truly something that can enhance your life and your family’s life and your ability to earn.”

“It becomes a great recruitment tool to say to folks, ‘When you come to work for us, you could be considered for this apprenticeship program, where you’re going to be able to work in the role you’re interested in today and earn money, and also have the funding for you to get an education and the time to do so.”

Stay in your lane at first

Having the scale to extend the program can make a program more attractive to potential partners and funders. While it’s aspirational at this point, Capital Senior Living recognized that it may be able to in years ahead take the program into communities in other states. This was also an attraction to the community college, because it could give them an opportunity to build relationships with community colleges in other states.

But for now, the focus is on building a solid program, one that connects the right employees to the right education. Building your own training or curricula, or creating something new from the ground up, can be tempting when there are many grants available to do that. But what’s needed now, Falke says, is a way to benefit the employees who are already in senior living or considering it.

The curricula and standards for certification are all there and ready. “This is about elevating and uplifting,” Falke says

Shine a Light on Your Processes to Help Reduce Ghosting

Your candidate looks good. They’ve checked out well. You’ve exchanged some texts or emails. But the day comes for the interview—or worse, the first day on the job—and they don’t show. You write and call and get nothing.

You’ve been ghosted. Unfortunately, most people in organizations know about this phenomenon from experience. It’s so common that the Federal Reserve Bank of Chicago added the term to its “Beige Book,” a noted reference on employment trends.

An Indeed survey says you’re not alone in the dark. The online job board company reports that most employers say it has only become a serious problem in the past two years, but it’s a big one: 83 percent of employers said they’d been ghosted.

And in senior living? In a quick poll taken at an Argentum webinar on the subject, 59 percent called it a “major issue.” Although neither poll is sound enough for science, both give an indication of the extent of the problem.

Articles and experts have weighed in on possible causes: generational behavior, people’s lives moving faster, mobile communication, the tight labor market, all of the above. But key to preventing it, experts say, is examining hiring processes and practices with a goal of getting and keeping engagement.

Make the process dynamic

The Indeed survey showed “hiring process was too slow and too long” as the top complaint, no matter what the age. Among the 18- to 24-year-old group, 27 percent got impatient, compared with 18 percent of the 45- to 65-year-old group.

The experts in Argentum’s webinar concur. “With the tough labor market, a lot of the candidates will drop out of the process,” said Anthony Ormsbee-Hale, vice president of people operations at Civitas Senior Living and a former community executive director.

“If it’s redundant, if it’s time-consuming, if it’s not mobile-friendly, then you’ll see a significant drop-off rate from your ‘website visit’ to your ‘application completed by’ scores.”

Yet many steps in the senior living hiring process, such as TB tests or getting an idea of a person’s capacity for caring, can’t happen fast.

To counter this, Civitas works in stages. It starts the process quickly, collecting basic information and a resume. If a candidate doesn’t have a resume, there’s an online resume builder right there to help create one. Screenings, references, and other checks also go in stages.

The multiple contacts and touchpoints give the potential employer more opportunities to show they care—and won’t leave a candidate going through long periods of wondering what’s happening.

It’s not about generations

There’s a widespread perception that ghosting is done only by young people. But the Indeed survey and other sources on the subject say that’s not quite accurate, though younger people do tend to do it more often. The Indeed survey reported a good percentage of younger people ghosted because they simply didn’t know what to do or how to say the words.

One no-show to a digital company had a friend call the employer with the news that the “ghost” had died, BBC World Service Business Daily reported. (He was later exposed, via a social media post.) The BBC also reported that in Japan—strongly a job-seekers’ market—there are services that will compose and send a message to quit or refuse a job, because people don’t want or can’t find the words to deliver the news.

“I’ve had the privilege of being here for two years, and even in the past year and a half, I’ve seen a change,” she says. Some, however, don’t ghost until they’ve been on the job for a few days—people don’t realize what it takes to work in senior living.

Look hard at community culture

In the end, the most sustainable solution to preventing ghosting is to examine company culture. Ghosting is not so much a problem in itself as a symptom of an engagement problem.

“We’re in the industry of caring—so why not show we care?” said Ashley Lodi, senior executive recruiter with MedBest executive search firm, which focuses on the senior living industry. She recommends getting to know a candidate as a person, before they get started—and welcoming an associate as you’d welcome an executive.

Taking down the silos helps, too. “From my personal experience as an executive director, I felt that it was really important for the entire team” to contribute to recruiting and retention.

“As executive director, I didn’t always have the answers, I didn’t always have the best ideas,” Lodi said, recommending communities create a culture committee or similar charged with ensuring new team members get a warm welcome.

Ormsbee-Hale agreed. The usual process in senior living of making the offer, then prescreening and testing, should be supplemented with other ways of making connections.

“We extend the offer, and then we do … all of these things that are really, quite honestly, not very fun.

“Then we expect the person to show up on day one very excited, when all we’ve done is bombard them with paperwork.

“You want to make the onboarding process as fun as possible—and onboarding starts before day one.”

Since adjusting hiring processes, Civitas has been able to reduce its number of candidates who don’t show up after an offer to roughly 1 percent.

The Indeed survey reports a 20 percent no-show percentage; a USA Today report put it at 20 percent to 50 percent; and the Society for Human Resource Management reports that one recruiter is seeing 50 percent no-show rates for restaurant and casino jobs.

The webinar speakers all agreed, however, that even a no-show is preferable to someone who “quits without leaving,” that is, stops putting in effort on the job. Senior living needs employees who have not only their minds on the job, but also their hearts.

Employees are Making This a Popular Perk: Earned Pay Apps

Cars always seem to break down between paydays. And for many hourly workers, who may not have a bank account or any savings, a simple car repair, a child’s bad cough, or even an expired parking meter can touch off a debt spiral.

Solutions have been limited. Swallow hard and ask relatives for a loan or a supervisor for an advance. Or go to a payday loan service, where interest rates can be as high as 400 percent. Other expenses may carry heavy late fees.

But recently, companies have been rolling out a product that might have better results: Cards and apps that allow workers to tap into their earnings before payday comes along. It can give immediate access to earnings.

Under a typical program, employees are charged per pay period a fixed fee comparable to that of an ATM withdrawal. For this, they may get a limited or unlimited number of withdrawals.

Another option is prepaid cards, which work like a hybrid of a debit card and a spending-limit credit card. Employees can load their card with earned income at any time. There are generally no fees to enroll, to load the card, or to withdraw cash at participating ATMs. The card doesn’t require a credit check, a factor that can also appeal to those with less-than-perfect scores.

“A very welcome perk”

“I was a bit reluctant,” Aaron Fenberg, director of human resources at Singh Senior Living, said of the program.

Employees can get their car fixed or pay for extra childcare and get back to work sooner, he says, which has had a good effect on employees and managers alike.

“They wanted to be paid on their schedule, not on our schedule,” Fenberg says.

The average amount withdrawn is $158, he says: “Not large amounts of money, just what they need at the time.”

Despite senior living’s unique job qualities, employers have to remember that on one level, they’re in competition with Walmart or Amazon, says Mark Woodka, CEO of OnShift, which offers a range of pay advance options. Walmart offers the cards, for instance—and all else being equal, offering comparable perks can make the difference in a hire.

It’s not about bad choices

According to a 2017 study by CareerBuilder, nearly 80 percent of American workers say they’re living paycheck to paycheck. Often, the solution is financial literacy or personal finance advice. While it’s fine to offer access to such resources, it may not be the best investment of time. Surveys at OnShift indicated that needing advance money is not an issue of employees having trouble managing their money or spending on a whim (though that image makes it clear why people are reluctant to ask for help).

Instead, employees are spending the funds on bills, groceries, rent, and unexpected expenses—often doing so online. Paying bills on time cuts late fees and helps establish financial resilience.

Cards can be paired with a larger financial management app. The app doesn’t give advice, but it does give tracking and calculations, showing where the money comes and goes.

Being able to make their own choices and not go to employers hat in hand helps people keep their dignity, Woodka says.

Tests may be ahead

While employees may like and use the apps, there may be some regulatory rumblings ahead.

The Wall Street Journal reported in September that scrutiny is coming from legislators in New York and California, who want to ensure such cards aren’t going to go the way of payday loans and that there are adequate consumer protections.

New York regulators, the Journal reported, issued a subpoena to Earnin, whose pay advance app is not tied to employment or company.

The system uses tips—no fees required. The Earnin entrepreneur and others who run such systems say they welcome regulators to take a very close look, so they can show that these systems are not, as Fenberg feared, “too good to be true.”

There are differences between advance pay apps and cards and payday loans. The apps can’t keep rolling fees over into the next pay cycle, thus keeping people out of the debt spiral that results from rapidly escalating interest rates. Payday loans also charge late fees, and they may hand debts over to collection agencies, which are known for hawkish methods.

But there remains the question: Employers don’t make money from these programs, so why would they use them?

Debt creates stress, says Woodka, and stressed employees are more likely to leave their job, at a cost of $3,500 to $5,000 per senior living employee. Worst of all, it influences care and residents’ quality of life. So instituting a perk that’s popular with employees and puts you on a par with the competition looks like a good investment.

Employers and others who use the apps recommend the following:

- Pair it up with a financial management program. It makes it easier for employees to track what they have, what’s coming, and what they need.

- Make it available to all—part-time and full-time workers. Many benefits are available only to full-time workers, but wide availability is part of what makes the program popular, Fenberg says.

- Make it easy to use by associates, with an app easy to access and download and good functionality.

- Get an easy-to-use system that becomes invisible—timekeeping, payroll, and other functions shouldn’t even know it’s there. Employers should have no risks (the wages are typically provided by an outside financial partner).