Leavitt Partners, a health care intelligence business founded by former secretary of U.S. Department of Health and Human Services Mike Leavitt, performed an analysis of several of these new revenue streams for Argentum. Through examining market forces and regulatory environment as well as interviews with decision-makers, Leavitt Partners provided a concise guide that senior living leaders can use to consider which alternates to pursue.

Shared here is a summary composed by Argentum of Leavitt Partners’ analysis and recommendations on telehealth. Analyses of this and five other alternate revenue streams, including Medicare Advantage approaches, appear in Argentum Quarterly Issue 3, 2019, which is available to members only.

Overview of current and future practices

Telehealth is the use of computer and mobile devices to access direct or supportive health care services remotely and manage health care. A wide range of options and practices fall under the category, from a remote check-in through a video call to a wearable that communicates basic health signs directly to a database.

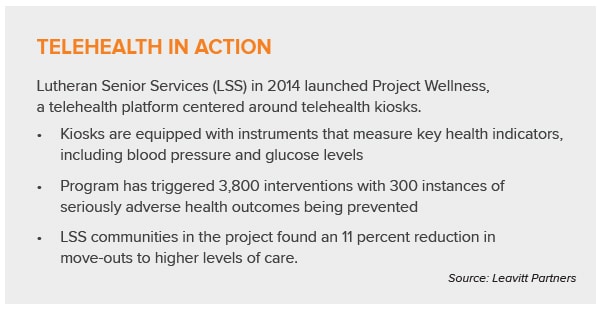

In senior living, it is shaping up to be a system whereby providers offer telehealth services within their communities by either contracting with a health system or a telehealth vendor or by developing their own telehealth platform. Providers might offer remote patient monitoring (RPM), wearables, health kiosks, virtual memory care exercises, or telehealth consults and check-ups.

Compact agreements, which allow health care professionals to practice remotely across different states, have faced a few struggles but are being approved in many states.

The regulatory outlook is generally favorable; in fact, the Creating High-Quality Results and Outcomes Necessary to Improve Chronic (CHRONIC) Care Act of 2018 specifically provided for increasing telehealth services for Medicare Advantage members.

Potential benefits

In the Leavitt Partners analysis, telehealth scores highest among the six streams on the x-y axis of ease of implementation and growth potential.

Benefits include:

- Telehealth programs can help improve care coordination among residents and enable better health outcomes

- Telehealth services can help detect health risks, inform proper care delivery, and reduce the number of resident move-outs to other care settings

- Senior living communities offering innovative solutions like telehealth can attract Medicare Advantage beneficiaries

- Virtual care in senior living may help mitigate staffing shortages, especially in rural areas

- Remote health monitoring has great potential for chronic health conditions management.

- Reimbursement trends are strengthening and beginning to favor the evolving landscape. The Bipartisan Budget Act of 2018 grants Medicare Advantage plans broader flexibility in covering telehealth services in plan year 2020.

In 2016, the number of Medicare telehealth claims submitted increased 33 percent (372,518 to 496,396), and total payments increased 28 percent ($22.4 million to $28.7 million). This uptick in total payments is not attributable to fee schedule rate increases, but rather to more providers using telehealth services with their traditional Medicare fee-for-service beneficiaries.

Telehealth is becoming more ubiquitous and presents opportunity for senior living providers to offer virtual care services at their communities.

Challenges to telehealth use

While use is increasing, it’s still far from common. Recent studies found only 12 percent of direct-to-consumer telehealth visits replaced a visit to another provider. This raises the question as to whether telehealth cuts or adds to net spending.

Vendor and infrastructure investments are another consideration. Electing to contract with a telehealth vendor to service virtual care services requires significant capital. Telehealth systems offered by vendors that include software, medical care devices, and mobile carts may cost upwards of $20,000 per community.

While regulations are generally favorable, some requirements can pose a challenge. These include managing strict confidentiality and patient access laws and monitoring which types of services must be in-person. Some services require an in-person visit before remote services can begin. The Bipartisan Budget Act of 2018 stipulates that any telehealth service offered by a Medicare Advantage plan must also be offered in person (303.a.3).

The regulatory environment

One key factor: Current legislation does not recognize senior living communities as qualifying originating sites for Medicare fee-for-service telehealth reimbursement. But this originating site requirement is not an issue for Medicare Advantage, which will expand telehealth coverage in 2020.

The CHRONIC Care Act of 2018 specifically encourages the use of telehealth to better manage care for individuals with complex needs. It expands telehealth use for Medicare ACOs, extended broader telehealth benefits to Medicare Advantage plans, and expands use of virtual care for stroke and dialysis patients.

In addition, the Centers for Medicare and Medicaid Services has issued a new interpretation of how statutory requirements apply to Medicare reimbursement for telehealth, in its 2019 Medicare Physician Fee Schedule (PFS). The new PFS provides broader reimbursement for certain virtual care services, such as virtual check-in, remote evaluation of pre-recorded patient information, and remote chronic care management.

Recommendations

Moderate-growth-minded senior living providers should:

- Explore potential opportunities to become an in-network provider of supplemental benefits for Medicare Advantage plans.

- Explore potential opportunities to offer telehealth services in communities through a relationship with a health system.